What is Choices Exchange? A guide to Make it easier to Find out the Principles And now have Started

Always assess the chance-reward proportion and you can demand benefits if being unsure of. There is often a myth one of individuals who possibilities involve highest exposure. Even when choices change may cause losings, individuals with enough market education can make much more profits over the years.

Fidelity Smart-money℠

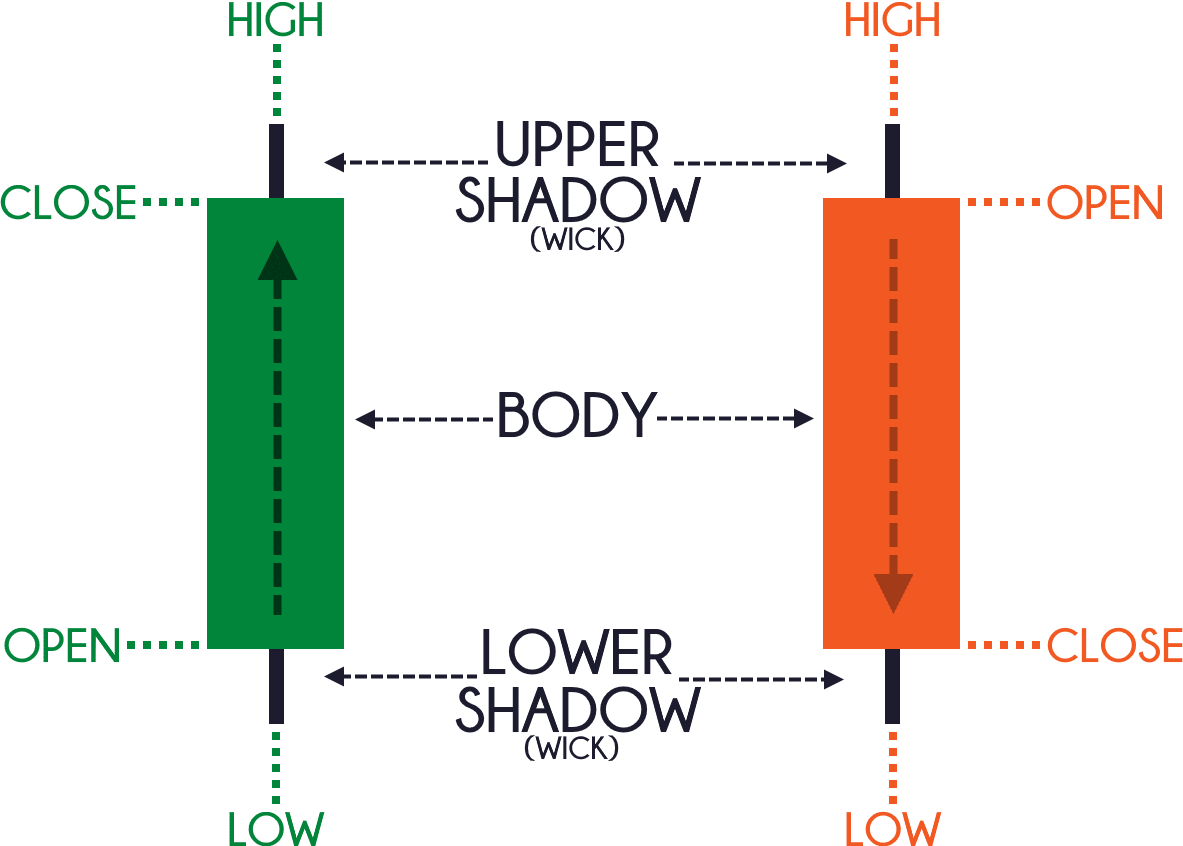

I’m trying to find purchasing the family as the I do believe the new property value our house have a tendency to delight in somewhat from the upcoming many years, although not, I’m not prepared to buy it in full today. Ben is the former Retirement and you may Using Editor for Forbes Coach. The individuals used to the new Greek alphabet have a tendency to claim that there is no actual Greek letter named vega. There are numerous ideas about how precisely that it icon, and that resembles the brand new Greek page nu, discover the ways to your inventory-trading terminology. Gordon Scott has been an active buyer and you may technical specialist otherwise 20+ decades. Tune in, there’s loads of perplexing slang and lingo that can exit you scratching your head, but the alternative will likely be divided for the five bits one will help you to know the way they work.

Like a broker and also have Accepted so you can Change Possibilities

The main downside away from options contracts is that they is actually state-of-the-art and hard to help you rates. Therefore options are often sensed a cutting-edge economic tool auto, compatible simply for experienced investors. In recent years, he’s getting increasingly popular certainly merchandising investors, as you can see lower than. A major upside to buying choices is that you features high upside prospective with loss restricted simply to the brand new option’s premium. But not, this can even be a disadvantage while the possibilities often end meaningless should your inventory will not circulate adequate to getting ITM.

- Tastytrade does not guarantee the accuracy or articles of one’s items or features given by Sales Representative or this web site.

- Choices trading plays a vital role on the financial industry while the it includes potential for people to deal with chance and you will speculate for the business motions.

- One of the primary risks ‘s the loss of the entire premium matter taken care of to buy choices.

- Concurrently, alternative exchange can be more cutting-edge than many other financial devices, as it requires buyers to own a great comprehension of the new hidden resource and you can industry conditions.

- As well, choices along with allow it to be investors to speculate to the cost of a great stock, usually elevating the risk.

However, while the deposit secured in the a fixed rates, the buyer pays $eight hundred,100. Let’s say couple of years features introduced, and now the fresh advancements are created and you will zoning might have been recognized. The newest homebuyer knowledge the option and you may expenditures your house for $400,000 because that ‘s the deal bought. Higher price shifts will increase the likelihood of a meeting happening. For this reason, the greater the new volatility, the more the price of the possibility. Alternatives exchange and you may volatility is intrinsically related to each other inside the in that way.

To do so, they have to spend a made, which you can think of as the cost of the fresh bookmark. Including, if an investor owns 100 offers from Business ABC and doesn’t have to sell, they are able to get rid of risk by buying a put option. If you are there’s the expense of the fresh superior, performing this still can always possibly defray several of its losses if Business ABC drops in expense, as the that could imply the newest set choice progress well worth. The brand new group promoting the choice accumulates the brand new advanced as well as the party buying the deal (whether that is an used or offer) will pay the new superior. The new premium changes considering precisely what the field anticipates when it comes of one’s choice achieving the strike price.

When selecting an alternative, they stays beneficial only when the brand new stock price closes the possibility’s conclusion several months “on the currency.” That means either above otherwise beneath the hit price. For many who concurrently get a trip and set solution for the same hit and you will termination, you’ve created an excellent straddle. So it position pays off if your fundamental speed rises or drops significantly; although not, should your rates remains relatively steady, you eliminate the newest advanced for the both the label and the place. You might enter into this tactic for individuals who expect a large circulate on the inventory but they are uncertain in which advice.

- Choose based on their feel peak, financial approach, and morale that have volatility.

- If your price of Acme Corporation got rather fallen in price, the possibility manage expire worthless and you will Karen will have forgotten the newest premium she repaid ($200).

- The main drawback away from choices contracts is that they are cutting-edge and you will tough to rates.

- Alternatives trade relates to certain points such hit rate, expiration go out, and you will alternative advanced, the price of the option bargain.

Meanwhile, if that same trader already have experience of you to definitely exact same organization and you can wants to get rid of one exposure, they could hedge the exposure by the promoting set choices facing you to definitely business. But proaircares.com not, should your individual is actually prepared to put up with particular level of downside chance, going for a less expensive aside-of-the-money (OTM) solution such as the $40 put might also performs. In this case, the cost of the choice reputation would be reduced in the just $200. At the same time, if the underlying price reduces, the new individual’s portfolio reputation loses worth, but so it loss is basically secure by get regarding the lay alternative position.

IV shows the level of price direction the brand new stock is anticipated to see along side option’s life span. So it metric will often ignite extreme changes in an enthusiastic option’s price single-handedly – including to identified occurrences, such income accounts and you will device releases. Really brokers designate some other quantities of options change recognition centered on the new riskiness and difficulty involved. The new five steps talked about here create all the belong to the most very first profile, level step 1 and you may level dos.

While we try and offer an array of offers, Bankrate doesn’t come with information about all monetary otherwise borrowing from the bank equipment otherwise services. After you’ve decided and that options your’ll end up being change, you can place your trading. It’s crucial that you play with a threshold order (not an industry buy) whenever position possibilities positions, or you might end up which have a much some other price to have your change than your expected.

According to your goals, numerous procedures is match the choices trading method. A trip choice is the alternative from an utilized alternative inside that it provides the option manager the proper, yet not the duty, to shop for a main advantage to your struck rate during the an excellent certain time period. But not, you could potentially trading option deals by themselves as opposed to previously being forced to get it done her or him, permitting make the most of alterations in the brand new contract’s worth. Although it also offers cash prospective, it is very important see the key concepts trailing alternatives agreements prior to trade. Usually, a tips package to own holds talks about 100 shares of the fundamental advantage.

Viewpoints shown try as of the new day expressed, in accordance with the suggestions offered at the period, and may alter based on industry or any other standards. Unless if you don’t listed, the fresh views provided are the ones of your presenter or blogger and you may not at all times that from Fidelity Investment otherwise their affiliates. Package that gives you the to buy an inventory from the a predetermined rate. The chance posts from possibilities is measured playing with five some other size referred to as “Greeks.” They are the newest delta, theta, gamma, and you may vega.

Centered within the 1993, The fresh Motley Fool is a monetary characteristics company intent on and then make the nation smarter, happier, and you will wealthier. The newest Motley Deceive is at lots of people per month due to our premium paying choices, free suggestions and you may industry investigation on the Fool.com, top-rated podcasts, and you will non-cash The brand new Motley Deceive Basis. Possibilities change allows visitors to imagine on the field actions, hedge current ranks, and you can probably generate income. Like all investment choices you create, you will have a clear idea of what you aspire to to do prior to exchange options. A stock solution (known as a collateral solution), provides a trader the best—although not the obligation—to shop for otherwise promote a stock in the a decided-through to rates and you can go out.

Alternatives trade performs a crucial role from the monetary industry as the it provides opportunities for buyers to manage risk and you will speculate for the business movements. Permits visitors to hedge its positions, securing by themselves against possible downturns and reducing loss. Choices trade are an economic derivative one to has the customer the newest best, although not the responsibility, to purchase or promote a main resource in the a specified rates inside a particular months. These possessions range from stocks, securities, products, otherwise currencies. Options cash calculators allow you to look at the output and you may profit otherwise loss of some other stock options procedures. To higher understand the arena of options trade, there are many tips which will help educate desperate traders.